Typically, these youth are participating in 4-H clubs, FFA, or a similar organization. Youth Loans are a type of Operating Loan for young people between 10-20 years old who need assistance with an educational agricultural project. Meet a Farmer: With the help of a low-interest microloan, Nik Bouman was able to purchase new equipment for his hydroponic basil farm, allowing him to quadruple his business and expand access to fresh basil in his community. They’re designed to meet the needs of small and beginning farmers, or for non-traditional and specialty operations by easing some of the requirements and offering less paperwork. Microloans are a type of Operating or Farm Ownership Loan. Today their family produces pure maple syrup in Trout Creek, Michigan. Meet a Farmer: Jesse and Tracey Paul purchased a farm using a Farm Ownership Loan. This loan can help with paying closing costs, constructing or improving buildings on the farm, or to help conserve and protect soil and water resources. Read more.įarm Ownership Loans can be used to purchase or expand a farm or ranch. Meet a Farmer: An Operating Loan helped Alaska farmers Brian and Laurie Olson expand their berry operation. It can also cover farm operating costs and family living expenses while a farm gets up and running. Operating Loans can be used to purchase livestock, seed and equipment.

#Agriculture land loan calculator full#

You can look up the current SOFR and Treasury Rates by using these links:įor a full description of the maximum interest rate rules view 2-FLP_Interest_Rate_Rules. ** SOFR is the Standard Overnight Financing Rate

These rules simply establish the maximum interest rates that may not be exceeded by guaranteed lenders at closing. Lenders are not required to directly price their loans on the SOFR or 5 year Treasury. *Note: If SOFR is less than 1.75%, lenders may add an additional 1% to each of the respective maximums above.

#Agriculture land loan calculator plus#

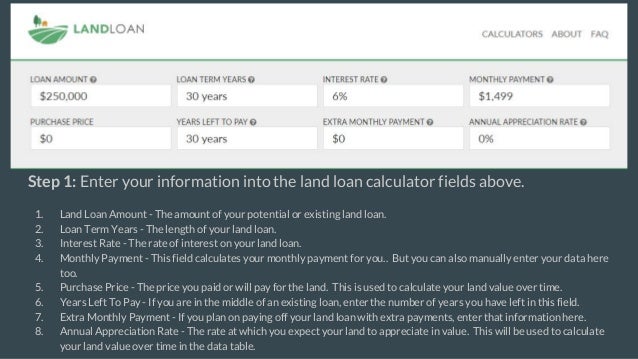

Interest rates charged by guaranteed lenders at the time of closing or restructuring may not exceed the following:įor loans with rates variable or fixed for less than 5 years: The prior business day’s SOFR plus 6.75%.įor loans with rates fixed for 5 years or more: The prior business day’s 5 Year Treasury note rate plus 5.5%. USDA Launches Loan Assistance Tool to Enhance Equity and Customer Serviceįarm Service Agency Expands Set-Aside Loan Provision for Customers Impacted by COVID-19 Use the Loan Assistance Tool to check your eligibility for FSA Loans, discover FSA loan types, learn about FSA Loan requirements, and walk through the easy-to-understand instructions when completing the forms. Our financial experts are here to assist you through this important process.The Farm Service Agency offers loans to help farmers and ranchers get the financing they need to start, expand or maintain a family farm. Tinker with our land loan calculator and see Maybe you need to save in other areas or find ways to generate extra income. If you’re wondering what size of a land loan you can afford, consider factors like input costs, overhead, and debt servicing. It’s easier to plan ahead and adjust your budget once you have a number in mind.Īrmed with this knowledge, you will feel more confident in choosing a financing option for your needs. You’ll know roughly how much your payments will be prior to talking to one of our loan officers. There are two main benefits of using our land payment calculator: It only takes a minute to fill in information such as purchase price, down payment, loan term, and interest rate. The loan calculator can give you an approximate monthly payment for a land loan. Our land payment calculator is designed to help you get a better grasp of your estimated payments regardless of financial knowledge.

0 kommentar(er)

0 kommentar(er)